Stochastic Momentum Index (SMI)

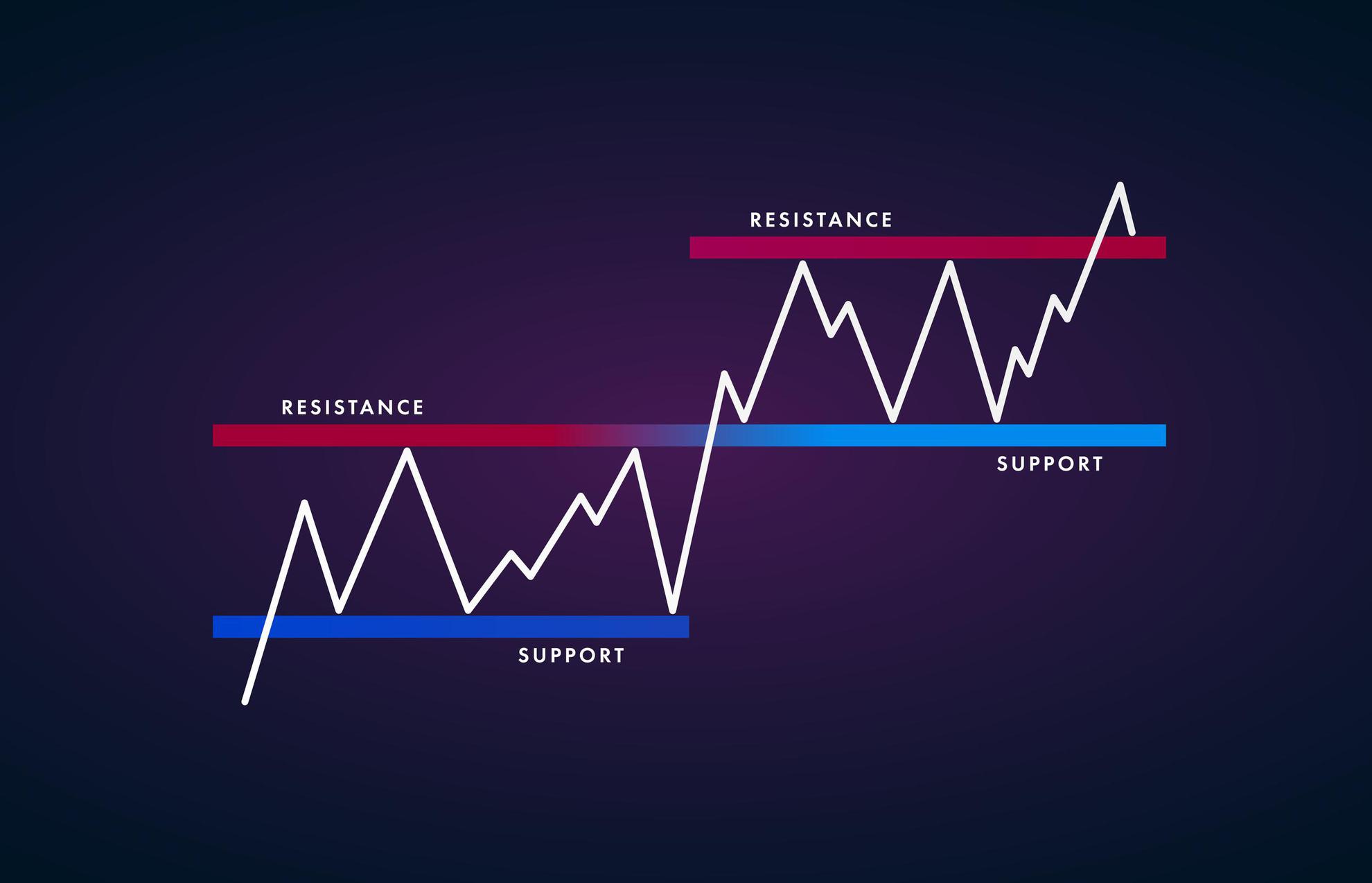

The stochastic momentum index (SMI) is a technical analysis indicator that shows price momentum by calculating its closing price distance relative to its median high-low price range. The SMI attempts to improve upon the traditional stochastic oscillator. What Is the …